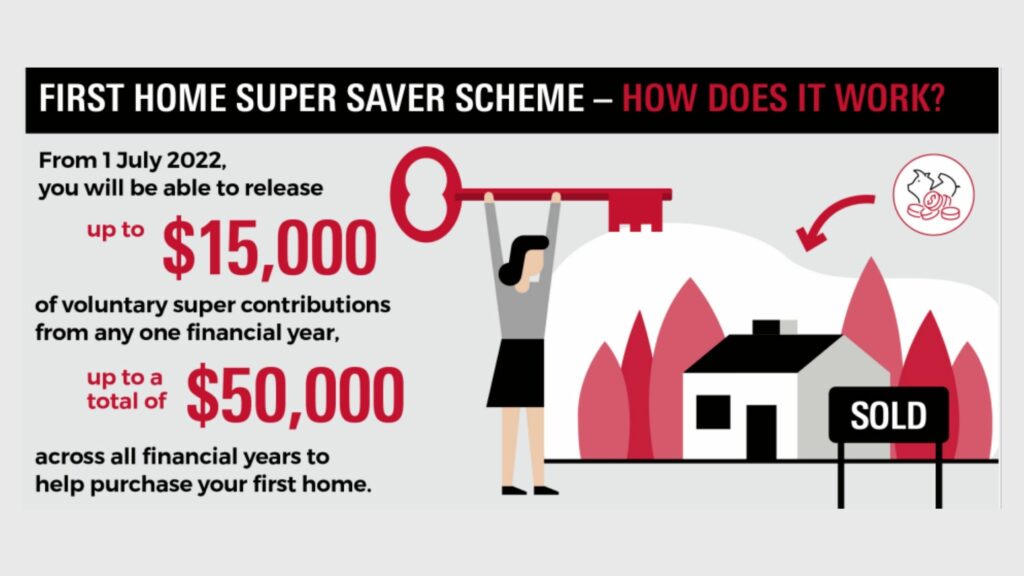

[vc_row][vc_column][vc_column_text]From 1 July 2022, if you’re a first home buyer you can release up to $50,000 (up from $30,000) from your voluntary super contributions to help you buy your first home.

Under the scheme, voluntary concessional and non concessional contributions made on or after 1 July 2017 may be released from super to help you purchase your first home.

Currently, you can release up to $15,000 of voluntary contributions from any one financial year, up to a total of $30,000 in contributions across all financial years, plus earnings on those voluntary contributions. Under the new rules, from 1 July 2022, you will be able to release up to $15,000 of voluntary contributions from any one financial year, up to a total of $50,000 contributions across all financial years, plus earnings.

To be eligible to participate in the FHSS scheme an individual must:

- be 18 or over

- have never owned property in Australia

- not previously requested a release of super money under the FHSS scheme.

The FHSS scheme can only be used to buy a residential home in Australia however it cannot be used to buy a mobile home. If vacant land is purchased, a contract to build a home on it must be signed within 12 months although a 12-month automatic extension will be granted. You must also intend to live in the home, the scheme can’t be used

to buy a residential investment property.

There are certain details around the withdrawal amount, associated earnings, tax on withdrawal and the release of the funds. To discuss your options, speak to a financial adviser.

To book an appointment today to discuss your Super, contact YBM Financial Services Pty Ltd today at our Orange office on 02 6362 1533 or our Molong office on 02 6366 8049 or fill out our contact form

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_btn title=”Contact Us” color=”warning” align=”center” link=”url:https%3A%2F%2Fwww.ybm.com.au%2Fcontact%2F|title:Contact%20Us”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]YBM Financial Services Pty Ltd is an Authorised Representative of Lonsdale Financial Group Ltd | ABN 76 006 637 225 | AFSL 246934

This is general advice only and does not take into account your financial circumstances, needs and objectives. Before making any decision based on this document, you should assess your own circumstances or seek advice from a financial advisor and seek tax advice from a registered tax agent. Information is current at the date of issue and may change. You should obtain a copy of the Product Disclosure Statement available from the product provider or your financial advisor and consider this before you acquire a financial product. This information and certain references, where indicated, are taken from sources believed to be accurate and correct. To the extent permitted by the Law, Lonsdale, its representatives, officers and employees accept no liability for any person that relies upon the information contained herein. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.[/vc_column_text][/vc_column][/vc_row]