While we cannot undo the damage Mother Nature has thrown our way, YBM are pleased that there are a number of assistance measures in place for individuals and businesses.

Disaster Declarations have been issued for a number of local LGAs, including Bathurst, Blayney, Cabonne, Cowra, Dubbo, Forbes, Lachlan Shire, Lithgow, Orange and Parkes. In turn, this means that assistance is now available.

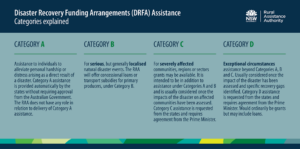

Keep in mind that assistance measures can change as the various levels of government start to communicate. Presently, local LGAs are classified as Category B in terms of disaster assistance (see below from the RAA). Should the regions be upgraded to Category C, additional support will become available.

YBM recommend you keep good records of any damage incurred to ensure applications, at all levels, are much smoother.

Pleasingly, assistance is available for individual households, small businesses, primary producers, sporting and recreation clubs and non-profit organisations. For now, here is what you may be able to access:

1. ‘Disaster Relief Grant’ from Resilience NSW

This is for individuals and families whose homes have been damaged by a natural disaster.

Key eligibility criteria:

- Your home, being your primary place of residence, was damaged;

- You do not have insurance for that damage;

- You are a low income earner with limited financial resources;

- It has been less than 4 months since the disaster.

To apply:

Phone 13 77 88 and ask about the ‘Disaster Relief Grant’ from Resilience NSW. For more information visit: https://www.nsw.gov.au/

2. Disaster Relief Loan – Small Business

Concessional loans (low interest) for small businesses to provide working capital and replace or repair property damaged as a result of the natural disaster. Loans of up to $130,000 can be provided, with the first two years interest and repayment free. This is followed by 10 years (total of 12 year term) with interest currently set at 0.8% per annum.

Key eligibility criteria:

- Fewer than 20 full time employees;

- Registered business, partnership or sole trader with ABN;

- The business provides the owner with more than 50% of their gross income;

- Business assets were significantly damaged as a result of the declared disaster event;

- The business was viable prior to the declared event, will be viable in the longer term and can demonstrate the capacity to repay the loan.

3. Disaster Relief Loan – Primary Producers

Concessional loans (low interest) for primary producers to provide working capital and replace or repair property damaged as a result of the natural disaster. Loans of up to $130,000 can be provided, with the first two years interest and repayment free. This is followed by 10 years (total of 12 year term) with interest currently set at 0.8% per annum.

Key eligibility criteria:

- Applicants, defined as individuals, partnerships, trusts or companies, have a right or interest in a farm enterprise (including lessees) and contribute labour and capital to the enterprise;

- At least 50% of the applicants’ gross income must come from the primary production enterprise (under ‘normal’ seasonal conditions);

- Assets, including fodder, were significantly damaged as a result of the declared disaster event;

- The entity was viable prior to the declared event, will be viable in the longer term and can demonstrate the capacity to repay the loan.

4. Disaster Relief Loan – Sporting and recreation clubs

Concessional loans (low interest) for sporting and recreation clubs to contribute towards clean up and/or restore facilities, equipment or assets damaged as a result of the natural disaster. Loans of up to $10,000 can be provided, with 5 year terms, principal and interest repaid monthly, and interest currently set at 0.8% per annum.

Key eligibility criteria:

- The range of sporting and recreational clubs that are eligible is broad. NSW Treasury may contact the NSW Office of Sport to request supporting documentation or information on a club’s status;

- The club must have incurred costs as a result of the declared disaster event that are not recoverable through insurance;

- The club must also show that it does not have the financial capacity to pay the costs from its own funds or reserves.

5. Disaster Relief Loan – Non-profit Organisations

Concessional loans (low interest) for non-profit organisations to restore essential facilities, equipment or assets damaged as a result of the natural disaster, or to obtain temporary storage or leasing of alternative premises. Loans of up to $25,000 can be provided, with 5 year terms, repayments dependent on the amount borrowed, and interest currently set at 0.8% per annum.

Key eligibility criteria:

- Applicants must be non-profit, voluntary, community supported organisations with services delivered at the local level. Any profit made by the organization must go back into the operation of the organisation to carry outs its purpose and not be distributed to any of its members. The organsiation must provide evidence of registration or incorporation as a non- profit organization;

- Facilities, equipment or other assets were significantly damaged as a result of the declared disaster event;

- The organization must show that it does not have the financial capacity to pay the costs from its own funds or reserves;

- The organization must demonstrate the financial capacity to repay the loan.

Guidelines and applications for the Disaster Relief Loans:

It is important to note that these are loans, not grants. Security will be required, in addition to documentation such as financial statements, tax returns and evidence of damage. YBM recommend that the Guidelines are carefully read prior to application. The following page will provide links for all Disaster Relief Loans, where you can access the Guidelines, download paper application forms or commence applications online: https://www.raa.nsw.gov.au/disaster-assistance/disaster-recovery-loans

6. Transport Subsidy – Primary Producers

Subsidies of 50% of costs incurred by farmers to transport fodder, water or stock due to a declared natural disaster event. A maximum of $15,000 can be claimed by an eligible applicant for each declared event.

Key eligibility criteria are largely the same as for the Primary Producer Loan above.

Subsidies are also available for owner/drivers in line with terms listed in the Guidelines:

https://www.raa.nsw.gov.au/__data/assets/pdf_file/0004/499441/Natural-Disaster-Transport-Subsidy-Guidelines.pdf

Applications and Claims are via the Rural Assistance Authority. Application and Claim forms can be downloaded, or online applications commenced at the following link:

https://www.raa.nsw.gov.au/grants/natural-disaster-transport-subsidy

As always, YBM are please to offer assistance with applications. Please contact us for help.