Our New Lending Service

Our new Lending Solution is designed to give you the best advice on all your lending needs and may be able help you save thousands of dollars annually in the interest you pay on your mortgage and other loan types.

Our new Lending Solution is designed to give you the best advice on all your lending needs and may be able help you save thousands of dollars annually in the interest you pay on your mortgage and other loan types.

Spring cleaning isn’t just about dusting shelves and organising files; it’s about refreshing your mindset. Here are some ideas to help you revitalise your life as we move into the warmer months.

Calculating capital gains on cryptocurrency doesn’t have to be complex. Our detailed guide covers everything from CGT events to record-keeping, ensuring you meet ATO guidelines and optimise your tax position.

Claiming tax deductions on rental properties in Australia can significantly enhance your investment returns. Understand eligible expenses, capital works, and the importance of meticulous record-keeping. Expert advice can further help in maximizing your deductions while staying compliant with tax laws.

Understanding how to calculate tax deductions for motor vehicles is crucial for individuals and businesses. Discover the cents-per-kilometre and logbook methods to maximise your deductions and reduce taxable income.

Learn how remote workers, whether freelancers or employed, can benefit from tax deductions. Understand eligibility, calculate expenses, and choose the right method to maximise savings during tax season.

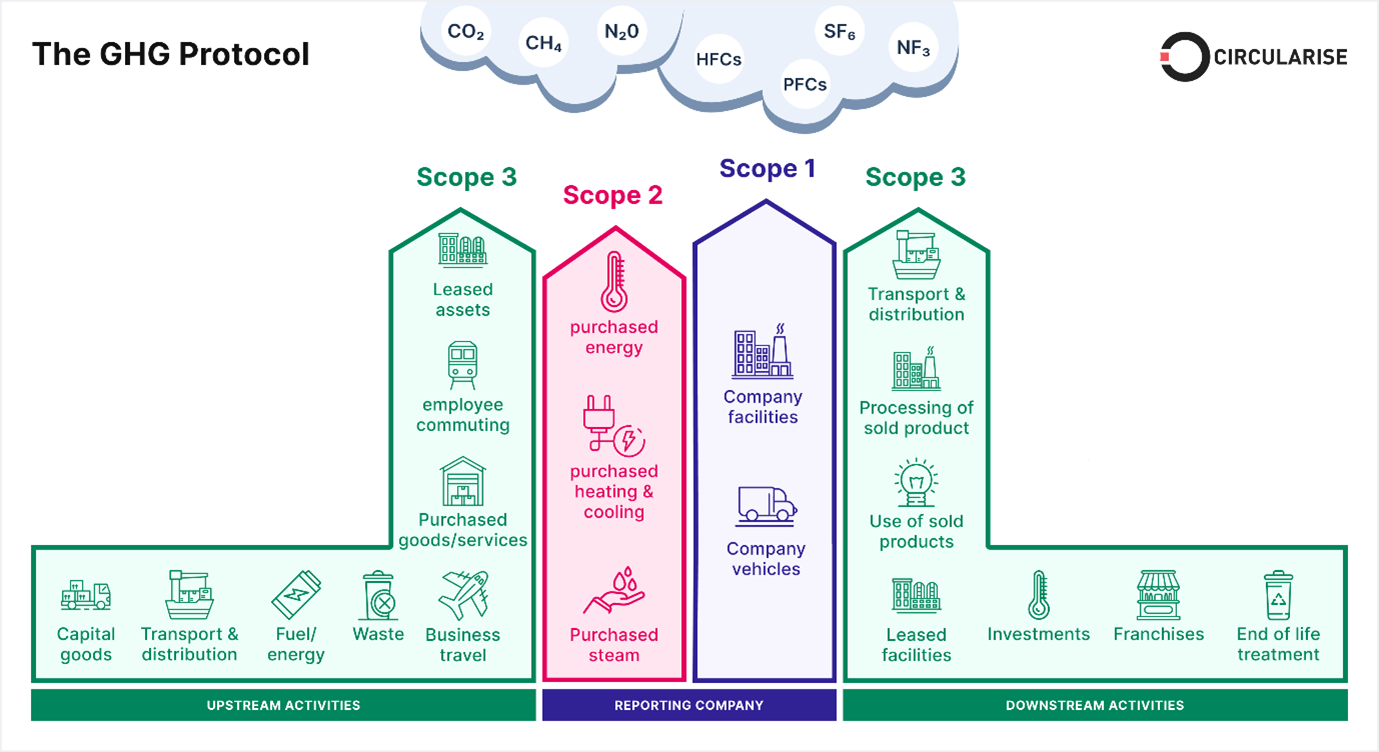

Discover YBM’s exciting adoption of Sumday, a cutting-edge Carbon Accounting platform, for proactive GHG reporting compliance.

Explains the nuts and bolts of reporting on GHG emissions, also referred to as Carbon accounting.

To keep clients ahead of the game, YBM are working on a number of strategies in order to provide assistance in this rapidly-evolving space.