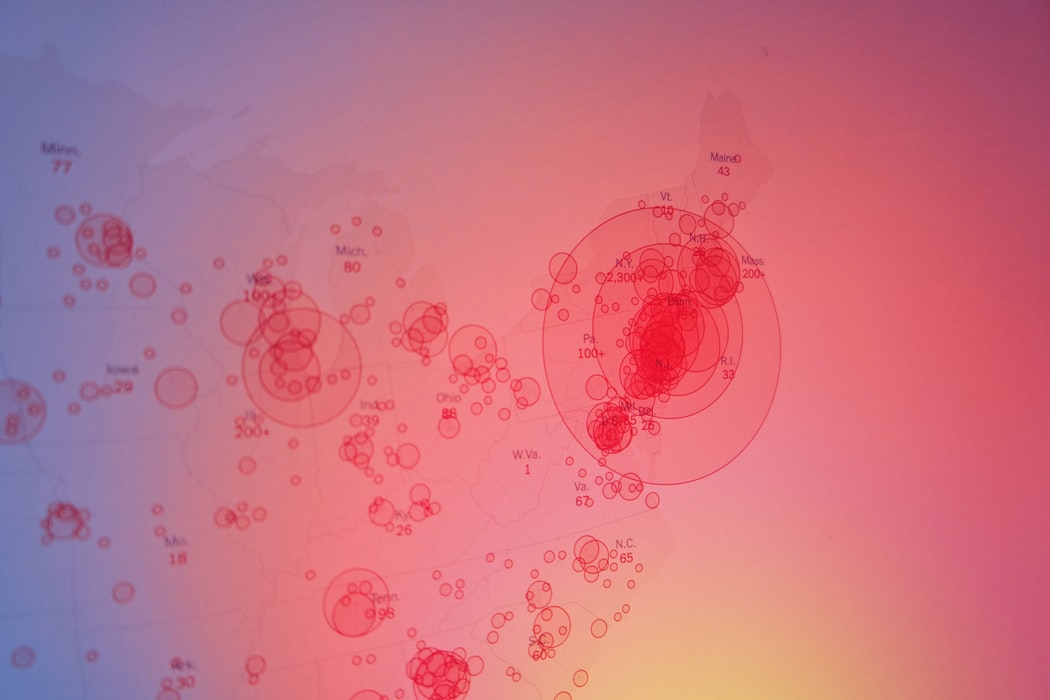

Coronavirus Stimulus Package – Changes to SMSFs

As part of the response to COVID-19, the ATO has announced some potential relief for a Self-Managed Superannuation Fund (SMSF) that rents a commercial property to a related party’s business.

As part of the response to COVID-19, the ATO has announced some potential relief for a Self-Managed Superannuation Fund (SMSF) that rents a commercial property to a related party’s business.

A $130 billion helping hand for businesses and their employees

I do remain my own boss. And this is worth taking the challenge!

First things first, grab a cup of tea.

A complete overview of the Federal Governments support package.

The JobSeeker Payment has been expanded to include sole traders, the self-employed, casual workers and contract workers who meet the income tests as a result of the economic downturn due to the coronavirus.

Businesses getting bank loans to tide them over and boost their working capital will now have 50% guaranteed by the government and a repayment holiday of 6 months.

Its official! The instant asset write-off for this financial year is now $150,000 and the eligibility has been expanded.

For taxpayers having financial difficulties as a result of the economic downturn caused by Coronavirus, the Australian Taxation Office (ATO) will provide support. This includes more time to pay their tax debt and payment plans that may have zero or low interest.

As part of the new Economic stimulus in response to the COVID-19 pandemic, announced on 22 March 2020, early access to superannuation may be available to those affected by COVID-19.